INTRODUCING ASAPP OXP 14.0

Increase your capabilities with ASAPP’s latest version

ASAPP OXP™ version 14.0 is out now, bringing enhanced features, expanded capabilities and increased access to feature sets for Client-Partners.

NEW FEATURES

Straight-Through Processing enhancements

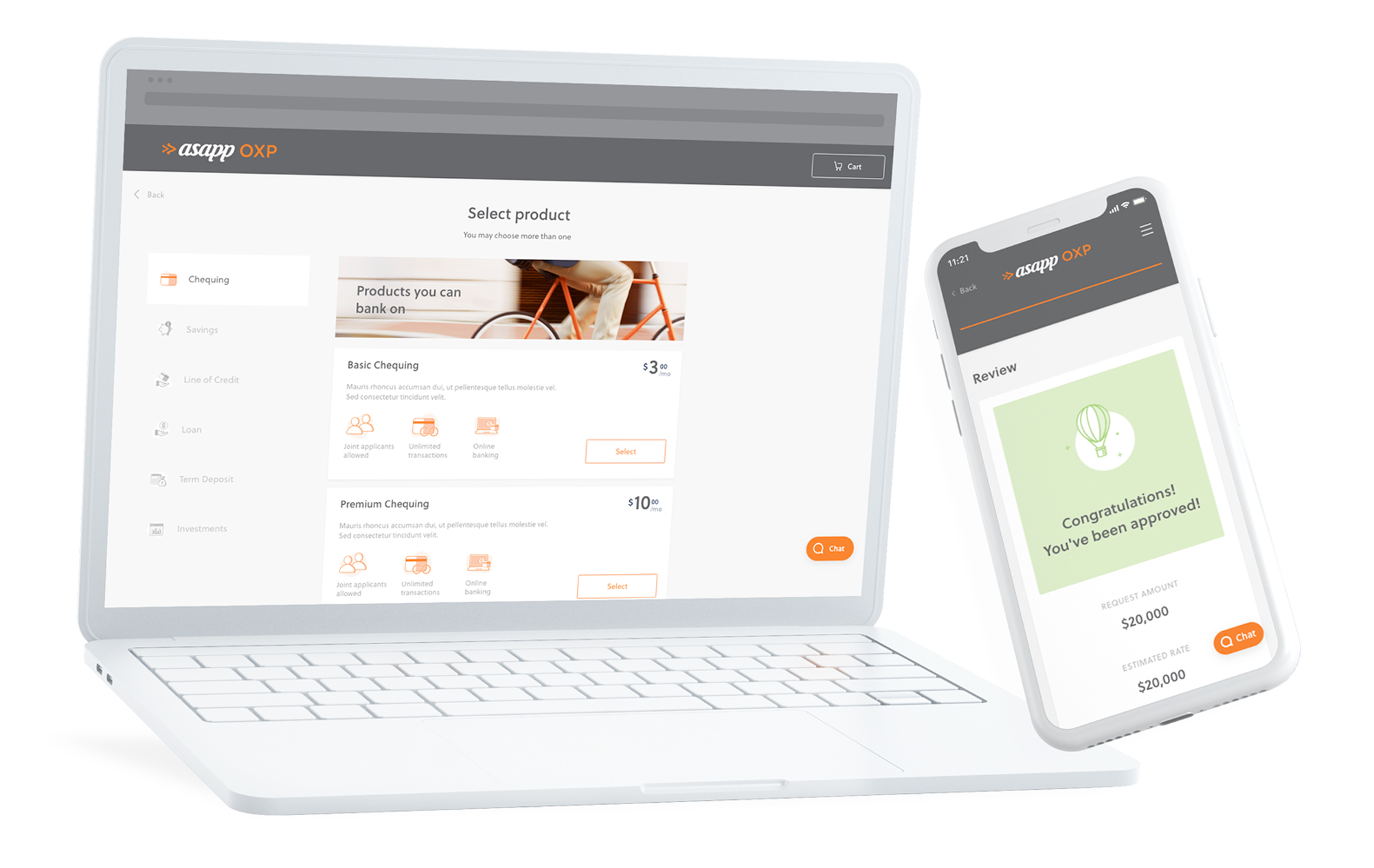

Straight-though processing (STP) was first brought to Client-Partners with ASAPP version 13.0, allowing credit unions and their members to benefit from increased efficiency and reduced of human error. With version 14.0, new STP configurations empower Client-Partners that license the ASAPP OXP Account Origination Solution to enforce minimum credit score requirements and restrict applicants to either single or joint applications. Additionally, ASAPP version 14.0 brings support for straight-through processing of unsecured loan applications.

ASAPP OXP uniCORE™ development

This release continues ASAPP’s expansion of ASAPP OXP uniCORE. Client-Partners who use this feature set can now leverage the ASAPP OXP Forge origination plug-in. Launched in early 2022, originally with a CGI RFS360 connection, the plug-in made ASAPP OXP Canada’s first account and lending origination platform integrated with an authenticated micro front-end plug-in within the Forge Digital Banking Platform. With the addition of the ASAPP OXP uniCORE™ DNA Connector this feature streamlines the account and lending origination process further. Keep a look out for more core banking integrations in future releases.

Expanded ASAPP OXP API and ASAPP OXP ECM feature set access

With ASAPP version 14.0, the ASAPP OXP API and ASAPP OXP Enterprise Content Management are available for Client-Partners who license ASAPP OXP Engagement feature sets. ASAPP OXP API benefits include the ability for Credit Union staff to request application lists and details in real-time for integration with third party systems. ASAPP OXP ECM enables Client-Partners to securely store and backup documents from the comfort of an intuitive and configurable interface. The ASAPP OXP ECM also automatically attaches all account and lending origination documents within a member profile in the ASAPP OXP CRM resulting in significant efficiencies for staff.

ASAPP 13.0 HIGHLIGHTS

ASAPP OXP Team Portal™ General Availability for all Client-Partners

The ASAPP OXP Team Portal™ was first introduced with ASAPP version 11.0, giving credit union team members increased flexibility and efficiency when leveraging ASAPP OXP Engagement feature sets. Next, ASAPP enhanced the Team Portal overall UX/UI with the version 12.0 release. Now, with version 13.0, the ASAPP OXP Team Portal is being released to all Client-Partners as a new centralized access point for ASAPP Platform users of both Origination and Engagement feature sets.

The new interface gives Client-Partners the following benefits 24/7/365, from anywhere, through the use of any internet-connected digital or mobile device:

- Single sign-on interface provides access to all licensed/implemented ASAPP OXP feature sets

- Streamlined internal communication strategies including managing announcements and configurable links

- The ability to tailor how Origination and Engagement content is displayed

- Centralized user management within one administration portal for all ASAPP capabilities

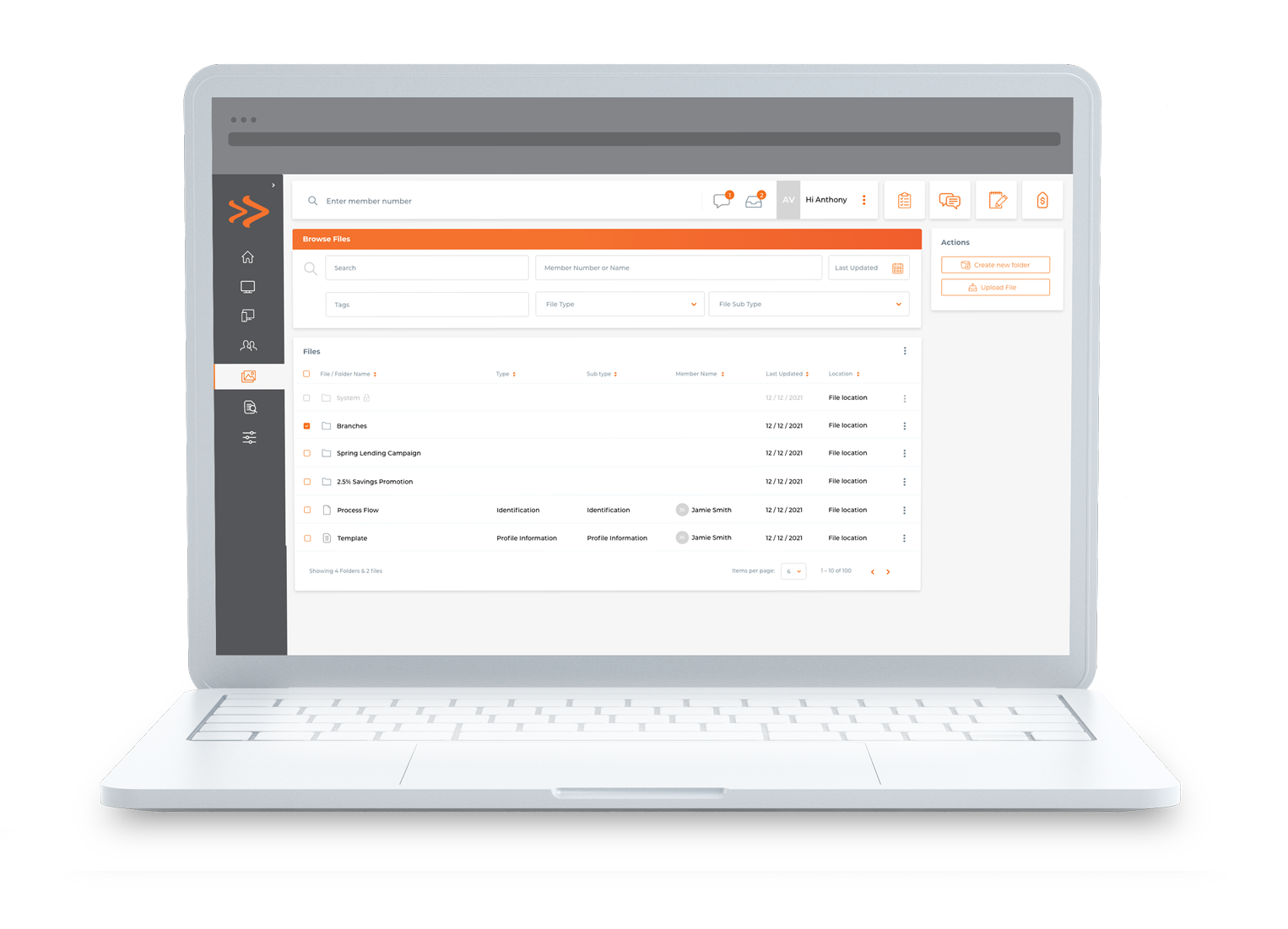

ASAPP OXP Enterprise Content Management

ASAPP’s ECM feature set allows secure, intuitive, and effective document oversight by staff. This ECM functionality has been rolled out in version 13.0 to ASAPP’s strategic testing and deployment partner and ready for broad release in version 14.0 in Q4 of 2022. This integration supports auto upload and tagging of all ASAPP Origination documents to the ECM, demonstrating the benefits of using ASAPP’s complete Platform.

The ECM feature set allows:

- File and folder creation with advanced search capabilities

- Typing, sub-typing and tagging files for quick locating

- Linking files to member profiles

- Member-linked files to automatically appear in CRM Member Profiles,

- Group-level folder and sub-folder access in to restrict access to specific folders within your organization

- Bulk downloading files based on selected folder and search results

Straight-Through Processing for ASAPP OXP Origination

ASAPP version 13.0 introduces new capabilities to support straight-through processing. This convenient feature allows new members to have instant account and member share provisioning, card provisioning and digital banking access when applying for digital accounts. Straight-through processing increases efficiency and decreases the risk of human error from both the new member and credit union employee perspectives. This new functionality is currently available for uniCORE-to-DNA and uniCORE-to-Xchange-to-DNA connections.

ASAPP 12.0 HIGHLIGHTS

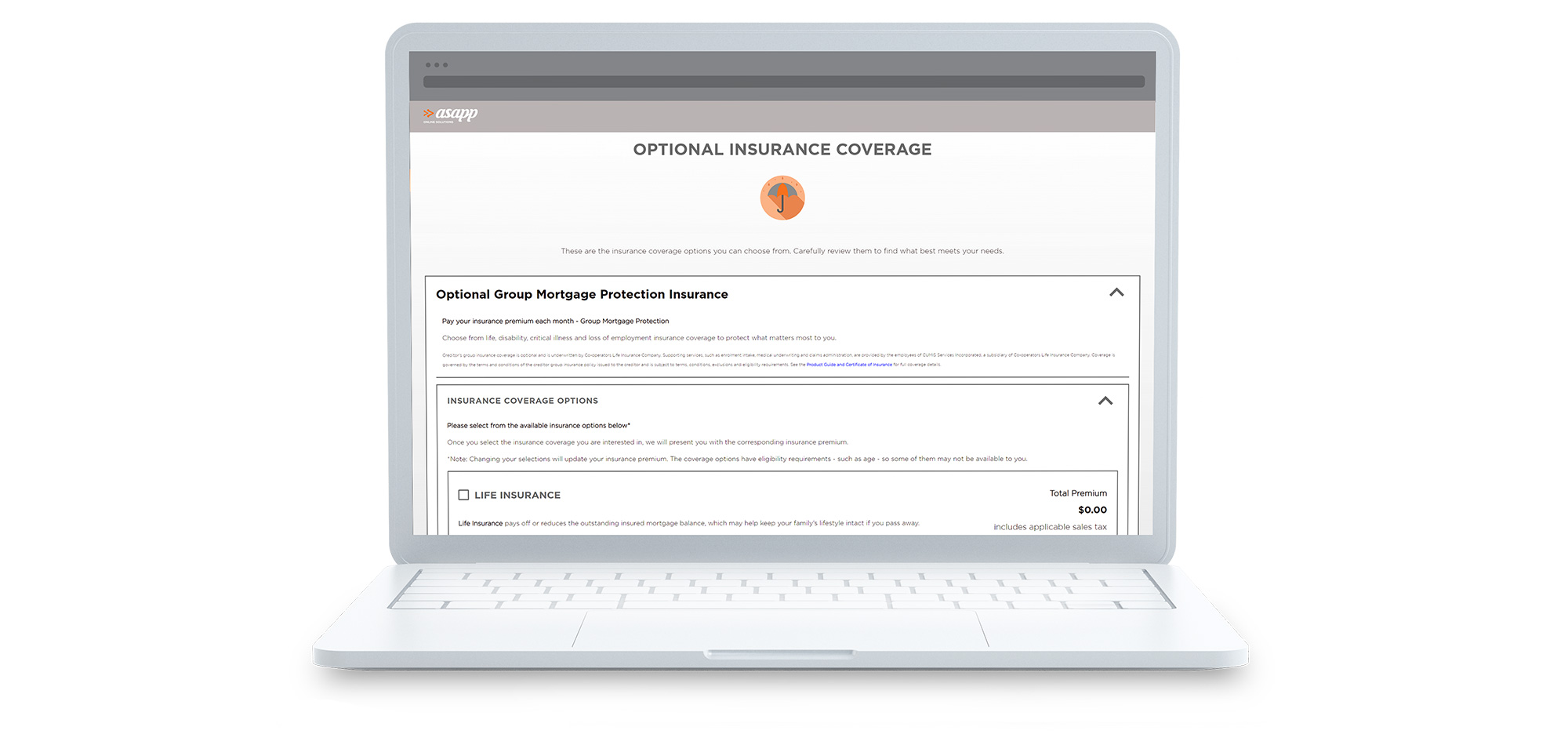

CUMIS Group Mortgage Protection (GMP) Integration

Frictionless mortgage protection is here for credit union members. ASAPP 12.0 brings GMP Insurance for mortgages to Client-Partners, speeding-up loan origination for new members both online and in-branch. This integration also provides the GMP creditor protection benefits program with their loan product suite in-branch, including lending facilities greater than $50,000 and / or members looking to add Loss of Employment protection plans to their credit facilities.

ASAPP OXP uniCORE™ Expansion with the DNA® Core API Connector

ASAPP continues to deliver cutting-edge solutions to credit union challenges through the development of the ASAPP OXP uniCORE™ Expansion with the DNA Core API Connector. With the ability to provide more agile, efficient, and cost-effective core banking connections, this technology was established as a middleware layer built on a modern Microsoft .NET Core microservice architecture. As of the version 12.0 release, it has been expanded to support DNA core API users and their connections to ASAPP OXP’s Origination and Engagement software. These upgraded services allow credit union members to receive faster support through retail / business deposit and lending account creation, card agreements, eAgreements, custom user fields configuration, improved committal interface / flow, and ASAPP OXP Engagement software capabilities (CRM, ECM, and Opportunity Management).

ASAPP OXP Data Warehouse

This exciting new feature leverages data from multiple sources to produce valuable insights as part of our Opportunity Management feature. Some of the convenient new functionalities include access to trends related to member and account-level data and indicators and opportunity generation within the ASAPP OXP Team Portal™. These new insights are enabled by querying member characteristics such as credit scores, account balances and average deposits. Additionally, the ASAPP OXP Data Warehouse leverages PowerBI connections for more advanced dashboarding or querying from the aggregate data set for those who license this through Office365. But that’s not all, the ASAPP Data Warehouse houses integral information with the ASAPP OXP Data Junction™ framework, which will be unveiled at the Fall 2022 Partner Forum.

ASAPP OXP Opportunity Engine™

The version 12.0 launch will help to credit union employees strengthen and form customer relationships through the release of the ASAPP OXP Opportunity Engine™. Client-Partner employees can gain deeper understandings of member relationships through the release of the ASAPP OXP Opportunity Engine™’s efficient and user-friendly querying abilities. Not only does it produce query results from core banking data in a few seconds, but this feature also generates lists of members for opportunity follow-up and assigns tasks to employees automatically.

Employees can search for results using the following:

- over 30 aggregate totals

- over 20 flags

- over 40 member-level attributes

- over 35 product-level attributes

MORE 12.0 UPDATES

- Increased efficiency – Improved address auto-parsing logic and checklists populating to application at initiation are just some of the new features which simplify administrative functions.

- Streamlined communication – New application list flags added to help identify channel origination, and new document library labels included along with expanded integration mapping capabilities all promote effective communication.

- Adaptable capabilities – The abilities to remove invalid IDs from application backend and include consumer payment obligations for both revolving and installment loan facilities for enhanced debt servicing calculations give Client-Partners increased flexibility. Additionally, Term Deposit flows have been enhanced to include additional data elements in front end and administrator portal

- New content block introductions for Jumio® and Flinks® to improve messaging

Keep your eyes peeled for ASAPP Version 13.0 – coming to UAT in August 2022. These exciting updates build upon the features of Version 11.0, detailed below.

ASAPP 11.0 HIGHLIGHTS

ASAPP IdentFI Biometric Identity Verification

Powered by Jumio

One of the most exciting additions in 11.0 is a new streamlined identity verification process, making it easier than ever to apply for your products or services. Through ASAPP IdentFI™, applicants can now have their identity validated in one simple 3-step process. This process not only helps validate applicant identity, but also uses OCR technology to extract information from the provided ID and pre-populate the applicant's personal information details, creating a shorter, friction-less application experience. Opening a simple demand deposit account can be done in under 5 minutes.

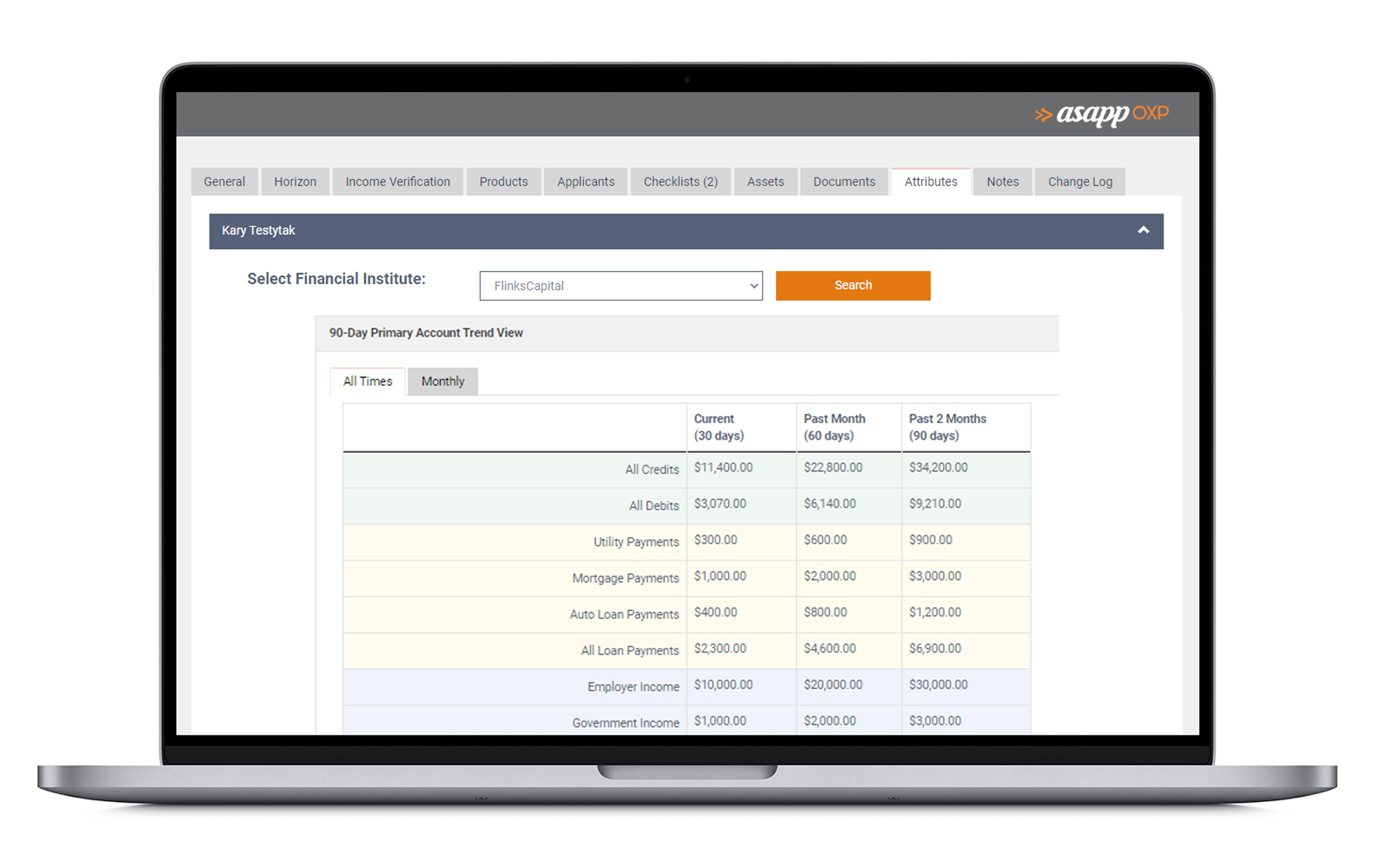

ASAPP inSIGHT Lending Adjudication Dashboard

Powered by Flinks

With our new ASAPP inSIGHT lending adjudication dashboard, we are able to leverage our Flinks integration and a custom set of Flinks Attributes to capture and display member data to inform lending decisions through the ASAPP LOS module. These data attributes provide insights into behaviour-based data through the banking information available through an applicant’s existing banking history with a connected FI. This allows you to view income information, payment behaviours, and other data points through the transaction history provided, giving you a more complete member view.

Business AOS/LOS UX Update

Our new Business User Interface Design is finally here! Complete with a more streamlined workflow, and a sleek design, its sure to take your small business application process to the next level. Perfect for in-branch, online and omnichannel origination opportunities and designed with both staff and applicants in mind, this newly designed business platform will surely be a way to improve member satisfaction and provide a differentiated experience.

MORE 11.0 UPDATES

- New Overdraft Auto-Decisioning for Chequing Accounts - ASAPP has now included Overdraft Auto-Decisioning functionality to our existing Chequing Account product configuration. Now you can fund your overdraft accounts with confidence using a simplified version of our LOS matrices to give a fast approval and rate to your applicants based on your unique credit model.

- New Document Portal - We’ve added functionality to help your team safely and securely request and receive supplementary documentation required from your applicants. This new functionality can be leveraged to require additional documentation relevant to the application process (ex. additional income verification, asset information, etc.) or can be used to custom request specific documents if necessary.

- Landing Page & Product Selection - In version 11.0, product selection landing pages have been updated to improve overall product selection experience. It's now even easier and more intuitive to add and modify products in your shopping cart.

- Personal Information Collection & Workflow - Collecting personal information is now divided into smaller sub-sections and saved as an applicant enters his or her information. This allows applicants to focus on 'bite-sized' chunks of information at a time and make data collection less intimidating.

- Declaration & Consent Management - The declarations and consents page has been updated to consolidate consents into one question, saving time by reducing the overall number of clicks required. A new configuration option has also been added to hide certain consents for existing Members.

- New Proof of Income Verification - Using our integration with Flinks, this update allows you to leverage financial data returned as one of the ways to verify and validate proof of income.

- Updated Review Page - The changes to the application review step make reviewing and updating information more intuitive. Sections are updated to match the revised order of data collection. Each section shows a condensed view of the information collected. Upon editing a section, the applicant is taken to the specific sub-section and returns directly back to the review screen after updating.

- Content Management - We’ve added the ability to filter content blocks by page, making things even easier for your teams to locate and update any new content adjustments you wish to make to your application workflow.

Looking to see all of these updates in action? Please request a demo below and we'll get back to you ASAPP!

Latest News